If ease of implementation and speed to market are priorities for your new exchange, an ‘off-the-shelf’ matching engine software solution can sound appealing. But it’s important to remember that not all ‘white label’ solutions are created equal as the definition is broad. While many solutions out there promise ease on the path to your first trade (in some cases just minutes!), the reality is far more complex.

Here’s what you need to know when choosing the right solution for your needs.

Customizing for Your Constituents

It’s crucial to choose a matching exchange software solution that provides your desired level of customization and flexibility. Some products may offer operators limited customization options, restricting branding and the ability to differentiate, while other products afford operators more discretion, but comes with fewer tools that have been proven in market. Whether it’s implementing specialized trading features, integrating unique components, or accommodating specific user preferences, the product you choose should match the level of customization your target audience, regulators, and growth targets require.

Build for the Buyer

Building a successful exchange is a multifaceted job that requires ongoing support and expert guidance, yet is meaningless unless the exchange is able to attract and retain liquidity of buyers and sellers on the exchange. While white label solutions provide a basic foundation, some may lack the professional services and support necessary to address complex technical issues and provide continuous improvements that will encourage a thriving marketplace. Without access to a team of engineers, developers, and support, exchange operators may find themselves unable to handle critical situations, security vulnerabilities, and tailor their market for sustained success.

Be Regulatory Ready

Depending on the industry, regulators may require controls, rules, or infrastructure provisions outside of the scope of technology that brands itself as being self-serve or SaaS (Software as a Service). EP3 customers like Tera Exchange require connections to unique vendors for their SEF approval, while other exchanges may have unique on-prem requirements. The decision to use SaaS or non-SaaS for all or parts of your exchange ecosystem depends on factors such as data security, regulatory requirements, and control over the exchange infrastructure. Exclusive access to your environment, hiring the right team, and utilizing the right tools to understand the health of the exchange are all incredibly important aspects of maintaining a fair, orderly, and compliant market. Components in EP3, like market surveillance, empower operators through features that allow for thorough monitoring and alerting.

Future-proof in the Present

The journey of an exchange doesn’t end with its launch; it’s just the beginning. As the market evolves and customer demands change, the exchange must adapt and scale accordingly. ‘Off-the-shelf’ solutions typically lack the flexibility to accommodate future needs and growth opportunities by not providing support, or professional services and there are often limitations in the product like the inability to add new asset classes, order types, or implement controls for impending regulation. Using a product that offers a layer of human support as Connamara Technology does can remedy many of these issues common with highly productized exchange solutions.

EP3 continues to grow and scale, implementing feedback from customers and extending its functionality and ease of use. A great example is our Jobs API, designed to eliminate a common headache for exchange operators and streamline the EP3 user experience.

Not Sure Where to Start? We Can Help.

By leveraging a platform like EP3, you get the best of both worlds — the proven functionality of an existing platform, with the customization, team, and resources you need to accelerate your time to market so you can focus on delivering an exceptional trading experience for your users.

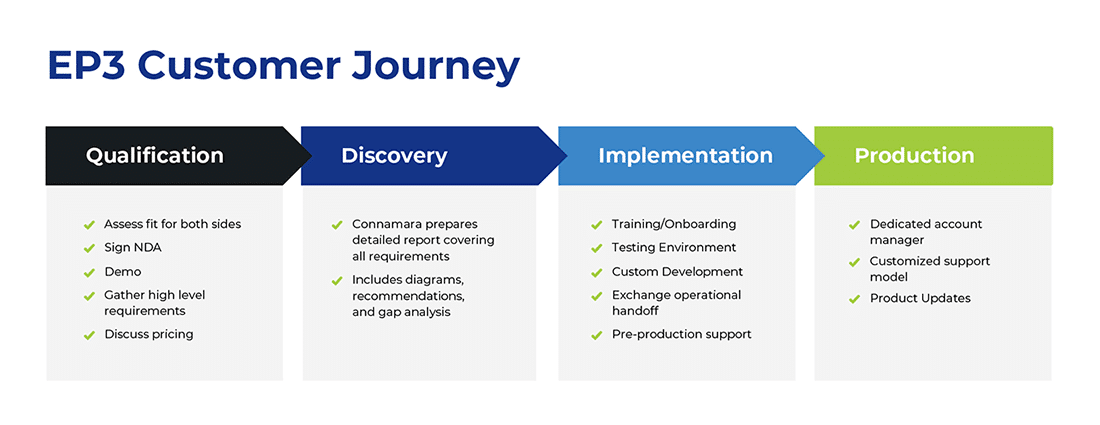

Learn more about our discovery process and how we can help you get to the first trade faster.