November 13, 2024, Austin, Texas — ForecastEx, a wholly-owned subsidiary of Interactive Brokers (IBKR) and a US-regulated predictions exchange and clearinghouse, processed an impressive $560 million+ in election contracts for the 2024 U.S. general election. The innovative technology driving those contracts? Connamara Technologies’ EP3 ® matching engine and exchange platform.

In the days leading up to and during election night, EP3 operated like the gears of a fine timepiece: inconspicuous, vital, and unfaltering. This synchronicity of unyielding performance weathered waves of volatility and seamlessly processed trades at a record volume.

Working in concert with ForecastEx’s internal teams, Connamara Technologies’ engineers monitored systems around the clock, ready to respond to surges in trade volume with precision and expertise. The team’s commitment went beyond standard duty, ensuring unparalleled service during this first-in-a-lifetime historic trading event.

With EP3 powering its trading, ForecastEx has not only established a benchmark for transparency in elections but has also offered the public real-time, market-based insights into election sentiment. EP3 operates from a legacy of trading knowledge that dates back to the late 1980s.

“While you may not recognize the name EP3 just yet, you’ll certainly recognize our impact. Whether you placed a trade or watched from afar, the 2024 election proved our technology’s resilience and our team’s commitment to deliver seamless, high-volume processing at every turn for future predictive events,” said Jim Downs, Co-Founder and CEO of Connamara Technologies.

As predictions markets continue to grow, the unseen elements – the EP3 technology and the engineers who support it – will remain crucial to providing reliable, transparent platforms that allow for public sentiment to be expressed and analyzed in real-time. Moving forward, Connamara Technologies aims to expand EP3’s reach, enabling new exchanges and markets to take advantage of this dependable backbone technology.

About Connamara Technologies

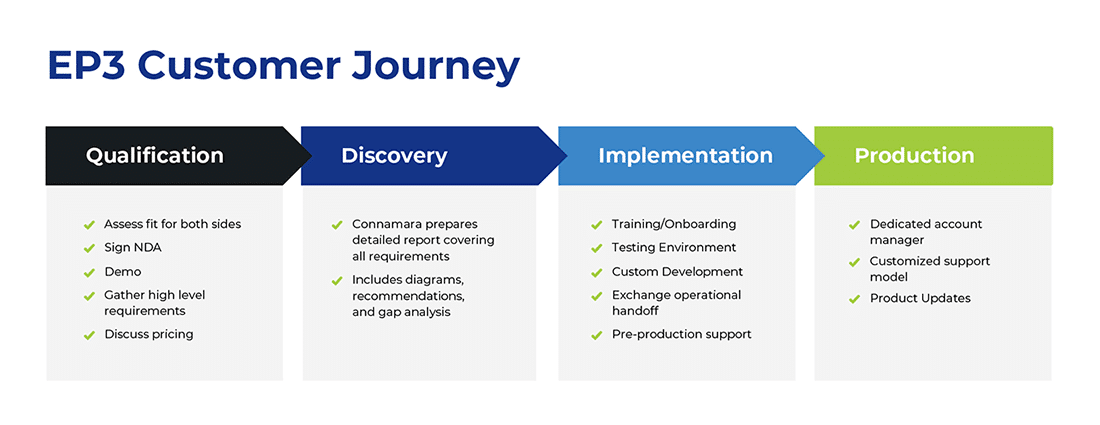

Connamara Technologies is the leading provider of fully-integrated exchange infrastructure, empowering new and existing exchanges to operate with exceptional efficiency and reliability. Its EP3 platform is a new breed of exchange and clearing technology that seamlessly integrates all key functions into a single, robust platform. It is cost-accessible, adaptable, scalable and quick-to-market. Engineered for the evolving needs of the next generation of exchanges and marketplaces, EP3 is shaping the future of financial markets.

To learn more, please visit www.connamara.tech or connect on LinkedIn

Media Contact: [email protected]

###