We are excited to announce that Connamara Technology has joined the Environmental Markets Association (EMA). This membership highlights our dedication to creating innovative exchange platforms for environmental markets.

As an EMA member, we’ll have the opportunity to engage with industry leaders in the evolving landscape of environmental markets such as carbon offsets, alternative energy trading, and other asset classes still yet to be created. This will help Connamara develop tailored solutions that effectively address the unique challenges faced by this industry.

About the Environmental Markets Association (EMA)

EMA functions as a dynamic hub for collaborative efforts, uniting diverse perspectives with a shared objective: the effective implementation of market-driven solutions to benefit our environment.

With members that include environmental asset brokers, exchanges, large utilities, law firms, project developers, consultants, academics, NGOs and government agencies, EMA acts as a focal point for sharing expertise, facilitating knowledge transfer, and advocating for industry-wide progress.

Notably, EMA assumes the role of vigilant oversight, closely monitoring legislative and regulatory developments that impact these markets, thereby ensuring their adherence to high standards of environmental responsibility.

Transforming Insights into Innovation

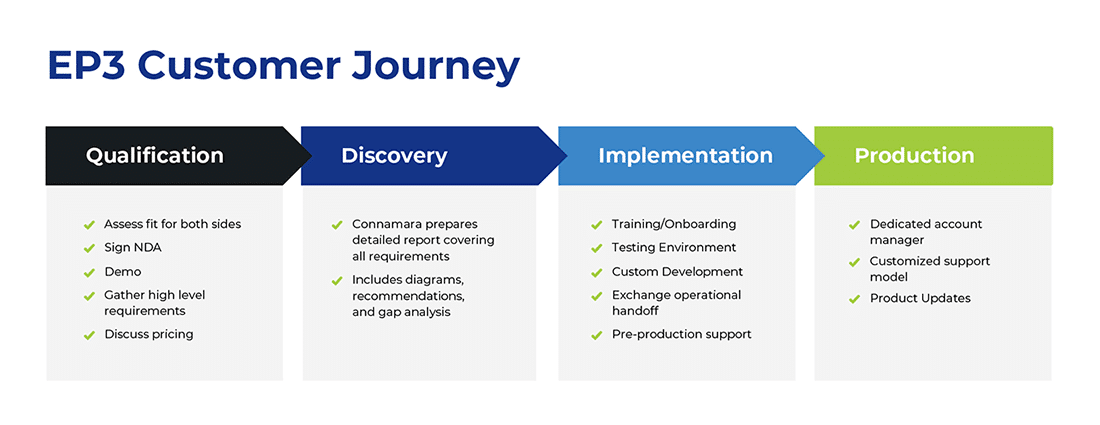

With our proven track record of delivering EP3, an exchange matching engine and platform, for a variety of markets worldwide, the alignment with the EMA furthers our mission to open new cutting-edge markets and improve infrastructure for existing markets to evolve with the industry.

At Connamara, our expertise lies in crafting scalable, dependable, and adaptable exchange platforms that empower marketplaces to operate their market with confidence and ease. With our EMA membership, we strengthen our ability to engage directly with market participants so that EP3 has up-to-date functionality, providing comprehensive solutions that align with the highest standards of market integrity within environmental markets.

“Connamara has always been a leader in developing new markets so it was an obvious decision for us to join the Environmental Markets Association given our prior experience with environmental market technology and evolution going on in the industry,” Connamara’s Head of Growth Dan Davis said.

Delivering an Environmental Market Advantage

By choosing Connamara Technologies as your exchange matching software provider, you get an ecosystem of expertise, collaboration, and thought leadership designed to foster your growth and success in environmental markets.